Fannie Mae and Freddie Mac recently announced a major change to the way they assess credit scores when multiple clients are on a mortgage. This update could help more borrowers qualify for a home.

How do these changes compare to the old guidelines? We’ll discuss this and more in today’s blog.

Credit Scoring Update

With the recent changes, if there are multiple clients qualifying to purchase or refinance a home, Fannie Mae will now average the median credit scores of all borrowers. How is different? In the past, Fannie Mae looked at the lowest median score of all clients on the loan.

Understanding Your Credit Score

When applying for a mortgage or any loan, your lender will pull your credit score.

A credit score is a number that lenders use, along with other information, to determine if someone will qualify for a loan. An algorithm uses data in your credit report to calculate your credit score. Your credit report shows the following information:

- How much you owe 30%

- Length of your credit history 15%

- Payment history 35%

- New credit inquiries 10%

- What kinds of credit you hold such as auto loans, credit cards and lines of credit 10%

Each of these factors carries a certain weight when calculating your credit score. Once the numbers are crunched, you end up with a credit score between 300 and 850. The higher the number, the lower the risk, and the more likely you are to qualify for a loan and a lower interest rate.

3 Credit Bureaus Explained

The whole credit industry is complicated and largely frustrating for the average consumer. What's even more frustrating is the fact that you don’t just have one credit score. You have quite a few of them, and this isn’t common knowledge.

The three main credit bureaus you’ve probably heard of are: Experian, Transunion, and Equifax. It’s important to understand that while most information collected by these three is similar, there are differences. For instance, one credit bureau may have unique information captured on a consumer that is not being captured by the other two, or the same data element may be stored or displayed differently by the credit bureaus.

For example: The FICO scoring system design is similar across the credit bureaus so that consumers with high FICO Scores on bureau "A's" data will likely see a similarly high FICO Score at the other two bureaus.

It is likely the underlying data in the credit bureaus is different and thus driving that observed score difference. However, there can be score differences even when the underlying data is identical. Why? Each of the bureau’s FICO scoring system was designed to optimize the predictive value of their unique data.

Scoring Models Used by the Mortgage Industry

There are many scoring models, but the two main methods are FICO and Vantage. FICO is the scoring model used by the mortgage industry, specifically Revision 9 which was introduced in 2017. FICO9 includes trended data, which is a historical analysis of credit payment “behavior”. Vantage, on the other hand, renders different scores than FICO. This model weighs different aspects of your credit report.

Although services like Credit Karma give you your Vantage score, these scores are not valid for mortgage qualification. The best way to be proactive and ensure the highest credit score possible is to monitor and manage your credit reports as there can be inaccurate information -It’s best to clear up any errors quickly.

Applying For a Loan Today

In the past, if an individual were to apply for a mortgage loan, lenders would take the median, or middle, credit score of the three as the qualifying one when they apply for a mortgage. And, if two borrowers applied for a loan, the lowest median credit score was used to qualify.

With the most recent updates, when two or more people are on a loan, Fannie May will now average the median credit scores of two individuals.

Since Fannie Mae has a minimum qualifying credit score of 620, this new change should help more clients qualify together on the loan, allowing for the use of all incomes to determine what they can afford. In addition, it also helps borrowers who are still working on their credit but may be applying with a co-signer. By averaging the two scores together, this opens the dream of homeownership to borrowers who may not have been able to obtain a mortgage in the past.

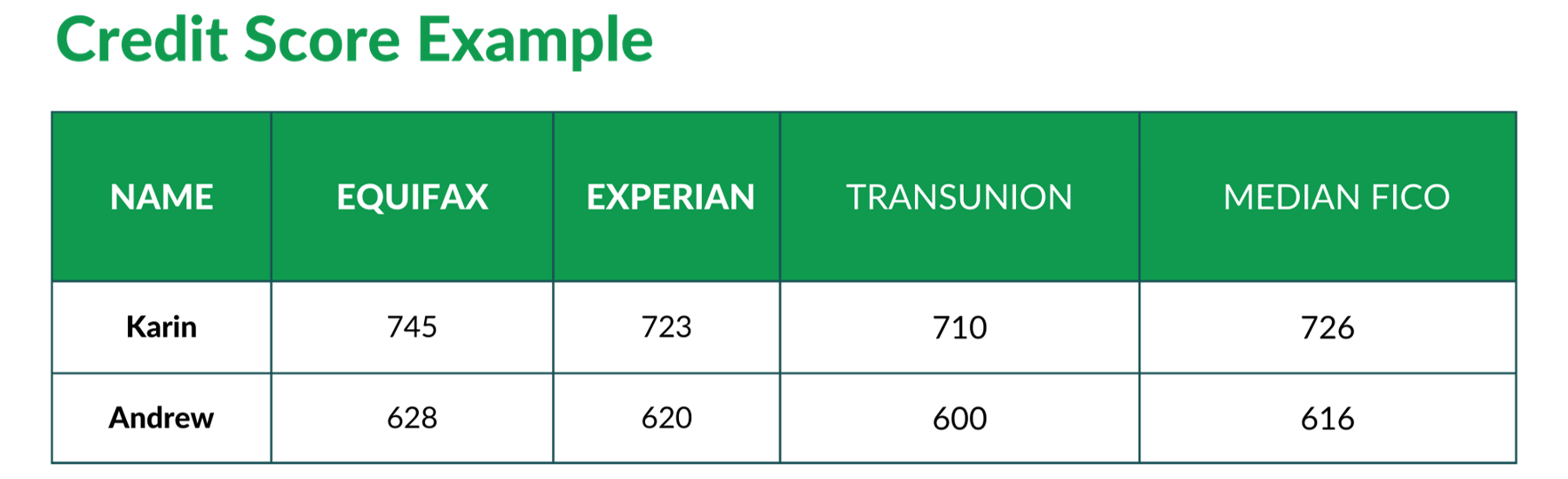

Median Credit Score Example

Let’s look at an example of two borrowers (Karin and Andrew) looking to qualify on a conventional loan together. This chart breaks down each of their credit scores from the three credit bureaus along with their median score.

Karin has a median credit score of 726 while Andrew has a median score of 616. Under the prior guidelines, their lender would not be able to use Andrew’s income on the loan because his median FICO score fell below 620.

However, when both of their median scores are averaged together, the new qualifying score becomes 671. This means both of their incomes and assets can be used to qualify for the loan. This is great news for Karin and Andrew as it allows them to qualify for a bigger loan whether they are looking to buy or refinance.

Conventional Loans vs FHA Loans

There are advantages to both Conventional Loans and FHA Loans.

FHA loans are designed to help first-time home buyers and experienced homeowners alike by providing them with a low-down payment option. It also helps borrowers with less than perfect credit apply for a mortgage.

FHA mortgage insurance serves as a protection for lenders in the event of a homeowner defaulting on their home loan. FHA insured loans often give potential homeowners the option of making a lower down payment than they would need to make if using a traditional, non-FHA insured mortgage.

FHA loans typically have minimum down payments as low as 3.5%. And with this type of loan, you won’t be stuck with mortgage insurance forever. The amount of time you’ll need to pay MIP depends on your down payment. For instance, if you have at least 10% or more, you’ll pay MIP for 11 years. If you put less than 10% down at the closing table, you end up paying for MIP the entire life of the loan.

With Conventional Loans, you can usually request mortgage insurance removal upon reaching 20% equity in your home. There is no upfront premium requirement pad at closing or added to your loan balance.

Bottom Line:

If you have been unable to get qualified for a mortgage loan in the past, now may be a good time to revisit. The new credit scoring changes are opening homeownership up for so many!

Visit our website to check out our Loan Programs or apply online today to get the process started.

Remember, getting pre-approved first is key. Getting an upfront loan approval will help you beat out the competition, negotiate with power and let you know how much you can afford.

Questions? Feel free to give us a call any time 833-345-1234.

We are here to help get you home with customized solutions solution that meet your needs.

Resources: